It’s nearly the end of the tax year and that can only mean one thing; it’s almost time to lodge your tax return.

The ATO has flagged three key focus areas for Tax Time 2024. These are work-related expenses, rental properties and taxpayers lodging their 2024 tax return too early.

It takes time for interest from banks, dividend income, payments from other government agencies and private health insurers to report to the ATO. Income statements must show as ‘tax ready’. For most people, the ATO will have this information by the end of July. Remember, accuracy matters, so it’s important we the take the time to get your tax return right. Best option is to wait a few weeks to ensure data matching doesn’t result in the ATO amending your already lodged tax return. Further reading is available here

We want to offer the most efficient and secure way to handle your return, especially if you have complex investments. Our professional standards code requires us to prepare detailed workpapers to support your return, which can be completed more efficiently when we have your information electronically. In-office appointments may not allow enough time for the detailed review needed therefore we encourage clients to send their information using the ‘’Send a File’’ option on our website.

The good news….

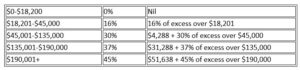

Taxation from 1 July 2024.

The long-awaited Stage 3 tax cuts will deliver savings of $4,529 per annum for those in the highest tax bracket, from 1 July this year. The average taxpayer will save $1,888 a year.

Super guarantee from 1 July 2024

From 1 July 2024 the Super Guarantee will increase to 11.5%. It will then increase by a further 0.5% on 1 July 2025 to reach 12%.

Contribution caps to increase from 1 July 2024.

From 1 July 2024:

- The standard Concessional contribution cap will increase from $27,500 to $30,000.

- The non-concessional contribution cap, which is expressed as 4 times the standard concessional contribution cap, will increase from $110,000 to $120,000.

- The maximum non-concessional cap available, under the non-concessional contribution bring-forward provisions, will increase from $330,000 to $360,000.

The total superannuation balance threshold, which is relevant for making non-concessional contributions, remains at $1.9 million during the 2024-25 financial year. The transfer balance cap also remains unchanged at $1.9 million.

Please ensure you seek advice for your specific situation.

The Instant Asset Write-Off Continues to the 2024-25 Financial Year for small businesses with an aggregated turnover of less than $10 million.

In a move aimed at bolstering small business cash flow and reducing compliance costs, the Australian government has announced an extension of the $20,000 instant asset write-off for another 12 months. This extension, part of the 2024–25 Budget released on 14 May 2024, will see the measure continue until 30 June 2025.

This initiative allows small businesses with an aggregated turnover of less than $10 million to immediately deduct the full cost of eligible assets costing less than $20,000. To qualify, these assets must be first used or installed and ready for use between 1 July 2023 and 30 June 2025.

It’s important to note that while these measures have been announced, they are not yet law. The Treasury Laws Amendment (Support for Small Business and Charities and Other Measures) Bill 2023, which includes provisions for the $20,000 instant asset write-off for the 2023–24 income year, is still before Parliament.

If you have any questions about this measure or any of the information provided, why not speak with one of our trusted team for answers? We are here to assist you with any questions or enquiries you may have.