Inside this edition, we cover some important updates on:

- Shadow Economy “Most Dobbed-In” Industries

- eInvoicing on the Rise

- SMSF Annual Report Requirements

- Increase to Age & Veteran Pensioners ‘Work Bonus’

- Credit Reporting Code Update – Financial Hardship

and more…

Shadow Economy “Most Dobbed-In” Industries

The “Shadow Economy” refers to activities taking place outside of tax and other regulatory systems, and in the 2021-22 financial year, the ATO received 43,000 tip-offs about business operating this way. The most common examples of this include demanding cash from customers, paying workers ‘cash in hand’, or not declaring all sales.

The most tipped-off industries in the past year were:

- building and construction

- hairdressing and beauty services

- cafés and restaurants

- road freight transport

- management advice & related consulting services

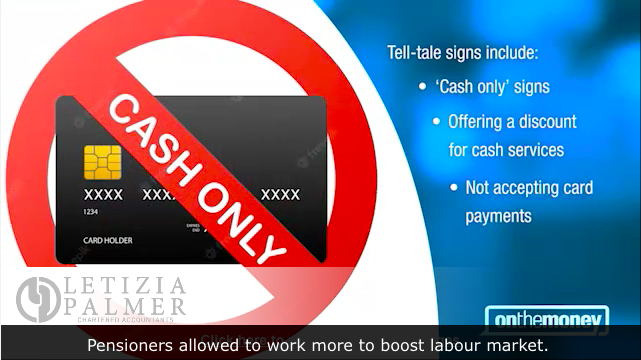

Tell-tale signs that a business may be operating in the shadow economy include having ‘cash only’ signs, offering a discount for cash, not accepting card payments, failing to provide payslips to workers, not ringing up sales, or even running illegal software that deletes or modifies sales transactions.

The ATO estimates the community misses out on around $11 billion in taxes each year as a result of “Shadow Economy” practices.

eInvoicing on the Rise

Over 18,000 business across Australia already use eInvoicing to make their transactions quicker, simpler, and more secure and the ATO is expecting significant growth with eInvoicing over the next 12 months.

eInvoicing is good for you and the environment; suppliers no longer need to print, post, or email paper-based or PDF invoices, and buyers no longer need to scan or manually enter invoices into their software. It also reduces the risk of fake or compromised invoices and email billing scams.

Get started with eInvoicing by registering your accounting software today, or check with your provider to find out if your software is eInvoicing enabled.

SMSF Annual Reporting Requirements

If your Self-Managed Super Fund held assets on 30 June 2022, you’re required to lodge an SMSF Annual Return (SAR) for the 2021-22 financial year. Your lodgement due date will depend on your circumstances:

- if you are a new SMSF and are preparing the SAR yourself, or if you have previously lodged a late SAR, you due date is 31 October 2022.

- if you are a new fund or had no assets on 30 June 2022, you will be required to make a return application or cancel your fund’s registration if you no longer wish to operate your fund.

If you need assistance with lodging your SAR, arrange an appointment with our team and we can advise you of your revised due date.

Increase to Age & Veteran Pensioners ‘Work Bonus’

The federal government has increased the amount that Age and Veteran Pensioners can earn and still receive a pension, by $4,000 for this financial year. This means an immediate $4,000 credit will be added to the ‘income banks’ of Age Pensioners from December, to be used this financial year.

The total amount pensioners can earn in a year before it impacts their pension, known as the “Work Bonus” would be $11,800 instead of the previous $7,800. The measure is designed to boost the labour supply by reducing financial disincentives for pensioners who want to work more.

This additional credit will be available until June 2023, subject to legislation being passed.

Credit Reporting Code Update – Financial Hardship

A new version of the Credit Reporting Code 2014 came into effect in July, relating to financial hardship reporting by credit providers and credit reporting bodies in Australia. Under these amendments, credit providers can enter into a financial hardship arrangement with an individual to adjust or defer their loan repayments.

Under the Privacy Act, financial hardship information will be reported on an individual’s credit report, alongside their repayment history information. The changes will give credit providers a fuller picture of a consumer’s financial situation. For example, they may be able to see when a consumer may be experiencing financial hardship due to an unexpected event such as a natural disaster.

The CR Code prohibits the use of financial hardship information to calculate an individual’s credit score and limits the retention of financial hardship information to 12 months. You can read about these new provisions and how they may affect you by visiting the Office of the Australian Information Commissioner’s website.

For More Information

For more detailed information on the above topics or the additional topics covered in this edition of On the Money, you can watch the video or read more here, or get in touch with our team directly.